Service Charges for POPs under NPS (All Citizen and Corporate)/NPS Lite – Master Circular

MASTER CIRCULAR

PFRDA/Master Circular/2024/05/PoP-03

Date: 25th April 2024

To

All Point of Presence (PoPs) and Stakeholders in the NPS/NPS-Lite

Madam/Sir,

Master Circular – Service Charges for POPs under NPS (All Citizen and Corporate)/NPS Lite

- This circular is issued in exercise of powers conferred under sub-section (1) of Section 14 read with sub -section (2) clause (m) of Section 14 of the Pension Fund regulatory and Development Authority Act, 2013 and Regulation 16 of the PFRDA (Point of Presence) Regulations, 2018 , as amended thereon.

2. This master circular consolidates the existing instructions on the subject of “Service Charges for POPs under NPS (All Citizen and Corporate/NPS-Lite)”. The list of underlying circulars on the subject is furnished in the Annexure-I.

3. This circular is issued with the approval of the competent authority.

Yours faithfully,

(Ashish Kumar Bharati)

General Manager

CONTENTS

PART I Introduction

PART II General Guidelines

PART III Service charges for the Point of Presence

PART IV Specific Guidelines

PART V List of circulars consolidated in the Master Circular -Annexure I

List of circulars Rescinded and Archived – Annexure II

Service Charges for POPs under NPS (All Citizen and Corporate) / NPS-Lite

PART I- INTRODUCTION

- With a view to incentivize the Point of Presence (“PoPs”) to actively promote and distribute NPS and provide better customer service, applicable charges for PoPs for the various services provided by them have been revised from time to time vide various circulars issued by the Authority. The effective date of applicability mentioned in respective circulars would remain unchanged.

2. The instructions contained in the aforesaid Master Circular have been suitably updated by incorporating relevant circulars, issued as on date.

PART II – GENERAL GUIDELINES

3. The compliance obligation of the PoPs shall not be confined merely to the Master Circular but, also to the applicable laws and regulations.

4. This Master Circular shall take effect from the date of its issuance but shall be without prejudice to their (earlier issued circulars) operation and effect, for the period when they were in force, until them being subsumed under the Master Circular. Based on the above caveat, Part V containing the list of circulars consolidated in the Master Circular – is placed at Annexure I, such that they are subsumed in the Master Circular and for all purpose and intent, remain operative, with no break of continuity. The list of circulars rescinded from time to time and archived is placed at Annexure II.

5. Notwithstanding such rescission of any circular, upon their merger in the Master Circular, or otherwise, anything done or any action taken or purported to have been done or taken, or to be taken hereafter, under the circulars now rescinded (for the period of their operation) shall be construed to have been validly taken as if the said circulars are in full force and effect and shall remain unaffected by their rescission, in any manner.

6. The previous operation of the rescinded circulars or anything duly done or suffered thereunder, any right, privilege, obligation or liability acquired, accrued or incurred, any penalty, any order passed, any violation committed, any investigation, legal proceedings pending in terms of the circular (now rescinded), shall be treated as if the circulars are in full force and effect, and shall remain unaffected by their rescission, in any manner.

PART III – SERVICE CHARGES FOR THE POINT OF PRESENCE

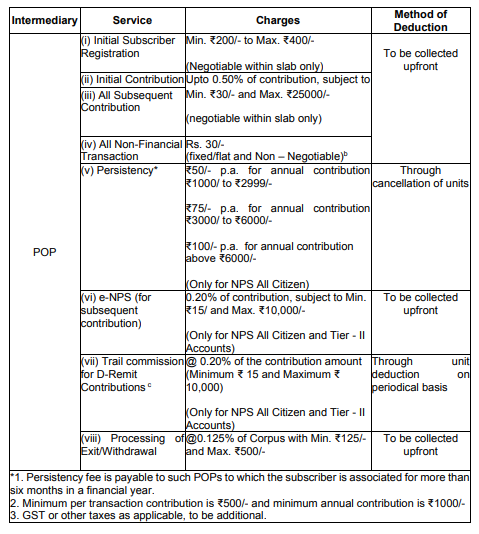

- The charge structure for PoPs under NPS (All Citizen and Corporate) are as below:

(Note – Kindly refer to Part V – Annexure I for footnotes a, b and c)

PART IV -SPECIFIC GUIDELINES:

8. The revision of service charges for PoPs on subscriber registration is effective from 01st February, 2022.

9. The PoPs will continue to have the option to negotiate the charges with the subscribers, but within the prescribed minimum and maximum charge structure.

10. Persistency charge per financial year will be applicable on accounts under NPS- All Citizen Model where the subscribers are associated with the PoPs for more than six months in a financial year. The applicable persistency charges at different level of contributions in Tier-I account during the financial year shall be as per the table at point – 7 above. This charge will be payable annually to the associated PoPs by deduction of the units in the CRA system after closure of the financial year.

11. The service charges on subsequent transactions by the subscribers associated with the PoPs who makes contribution through eNPS platform has been increased to 0.20% of the contribution amount subject to minimum of Rs. 15/- and maximum of Rs. 10,000/-. The revision of this service charge is effective from 15th February, 2022.

12. The trail commission to PoPs for D-Remit Contributions of the associated Subscribers shall be @ 0.20% of the contribution amount (Minimum ₹ 15 and Maximum ₹ 10,000) similar to eNPS. The applicable charges would be recovered by unit deduction on periodical basis w.e.f. 01.09.2022.

13. Processing of Exit/Withdrawal charges is 0.125% of Corpus with minimum ₹125/- and maximum ₹500/-.

14. The POPs shall make proper disclosure to subscribers about the charges being collected by them.

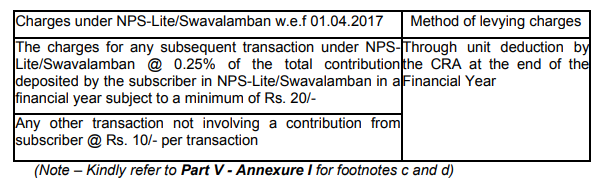

15. Charge structure under NPS-Lite/ Swavalamband are as below:

16. The Aggregators are not permitted to collect any charge or fee upfront from the NPSLite/Swavalamban subscriber.

17. In case of any violation of these instructions suitable action shall be initiated as envisaged in the PFRDA Act, 2013 and PFRDA (Point of Presence) Regulations, 2018 as amended.